If you’re a trucker and file heavy vehicle use tax? then the due date for filing your federal highway vehicle use tax return is generally August 31 of each year. You may want to file your return electronically? then you’ll usually receive your IRS watermarked digital Schedule-1 receipt in minutes when the IRS receives it online.

Getting started with 2290 eFile is quick and easy at

Electronic filing or eFile.

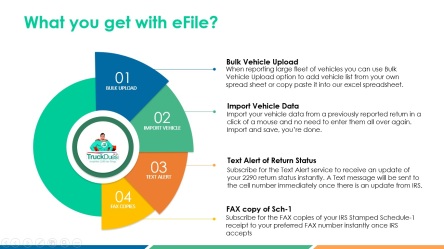

Electronic filing is required for each return reporting and paying tax on 25 or more vehicles that you file during the tax period. Tax suspended vehicles (designated by category W) aren’t included in the electronic filing requirement for 25 or more vehicles since you aren’t paying tax on them. However, you are encouraged to file electronically regardless of the number of vehicles being reported. File Form 2290 electronically. Once your return is accepted by the IRS, your stamped Schedule 1 can be available within minutes. You could download the same from your email or by accessing your account in the TruckDues website.

There are other various reasons that refer you toward electronic filing and they are,

Fastest, the fastest way to complete reporting your 2290 taxes with the IRS.

Convenient, most convenient too access it anywhere anytime. At your door steps and all you need is a computer with internet connection.

Guidance, step-by-step walk though and support from our representatives through your filing till you complete it.

Secure, most secured only you have the access to your date connects with the IRS servers directly

Simple, easiest way to do it. Answer simple interview questions and complete your 2290 return in a jiffy

Schedule-1 in minutes, choose eFile for quick delivery of their watermarked Schedule 1

Free VIN Correction, correct typos and misplaced VIN# instantly for free

eFile Amendments, other corrections on your taxable gross weight and mileage use limit made easy

More Accurate, report your taxes right. You won’t be missing out anything and human error could be avoided greatly.

Easy Access, available all day (24 X 7) from anywhere anytime to eFile 2290 or to download returns and schedule-1 receipts

Re-submit for Free, when your return gets rejected for mismatch of date correct it instantly and resubmit it for processing. Don’t even need an amendment return in case of rejection.

Most economic, obviously the most economical 2290 filing option and save big on your preparation fees. You could also do it by yourself and no need to hire a paid preparer.

Value for money, form 2290 efile starts at $7.99 for a single vehicle return and if you expect to file multiple returns through the tax period then go for our unlimited pricing option, $199.99 for a tax period.

Easy Claims, owe your refund on a traded or sold vehicles electronically, or adjust the claim against tax bill while report 2290 on a newly added vehicle.

Highly Safe, our website is 100% secured with SSL and Hacker proof premium software’s licenses.

No need for a drive, no more blocking appointments at IRS office or driving to get it filed, the service is at your door step.

High time to choose eFile, let this year 2018 be the year to choose eFile. Say no to paper return.

Smart eFile, 2290 eFile is the SMART option as 1000s of truckers already choosing eFile as their preferred choice when it comes to 2290 reporting.

One Question keeps coming up in your mind… How will I know the IRS has received my return?

You will get an e-mail notification from us. You’ll also have access to an electronic version of the Schedule 1 containing a watermark of the e-file logo in the background from IRS as PDF copy. Accepted across all state Department of Motor Vehicles and Dept. of Transportations.

TruckDues intention is to make 2290 electronic filing affordable and available to every trucker regardless of their size. Most of our customers are Owner Operators & Independent Drivers. We always offer our premium service to you to make sure you have a rewarding experience and start referring us to your business contacts, trucking friends and community to eFile 2290.

Call support available for free

Feel free to connect with us, we’re working from 9:00 AM to 6:00 PM CST on all business working days. You could also have a live chat with our agents and talk to them over phone. We’re available at (347) 515 – 2290 or support@truckdues.com.

35.517491

-86.580447