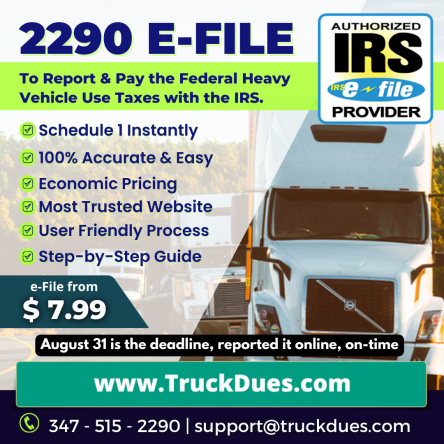

The Form 2290 to report and pay the Federal Heavy Highway Vehicle Use Tax returns is easy and fast at TruckDues.com. The economic and pocket friendly service is the most preferred partner for Truckers and Owner Operators, who wants to save their hard earned money. No need to spend more, it is just $7.99 for a single vehicle return at TruckDues.com.

The essential data that is required to be handy before you start your 2290 electronic filing.

- Employer Identification Number. You cannot use your Social Security number

Don’t have an EIN? Apply now; allow four weeks for your new EIN to be established in the IRS systems before filing your Form 2290. - Use the same name. Your e-file name control must match your EIN name.

- Vehicle Identification Number of each vehicle.

- Taxable gross weight of each vehicle.

- Tax Filing Period and the First Used Month – the month the vehicle first put to use in a tax year.

Every Trucker Due Now For Form 2290 This 2022 – 23 Tax Year

Truckers that have a highway motor vehicle with a taxable gross weight of 55,000 pounds or more registered in their name must file Form 2290 and pay the tax. However, on vehicles they expect to use for 5,000 miles or less (7,500 for farm vehicles), they’re required to file a return, but pay no tax. If the vehicle exceeds the mileage use limit during the tax period, the tax becomes due.